Qatar is an attractive jurisdiction because of its very low tax rates and opportunities for company development in an economy with high GDP and high quality of life. While foreign investors have certain restrictions in terms of foreign company ownership, they can start a company in Qatar by co-owning it with a Qatari national. Complete information about how you can set up a business in Qatar can be obtained from our company formation specialists in Qatar. Moreover, if you have decided to relocate to this country, you can solicit in-depth support from our immigration lawyers in Qatar.

| Quick Facts | |

|---|---|

| Types of companies |

Limited liability company Public shareholding company Joint partnership Joint venture Limited partnership General partnership Sole proprietorship Holding company |

|

Minimum share capital for LTD Company |

QAR 300,000 |

|

Minimum number of shareholders for Limited Company |

2 |

| Time frame for the incorporation (approx.) |

3 weeks |

| Corporate tax rate |

10% |

| Dividend tax rate |

– |

| VAT rate |

– |

| Number of double taxation treaties (approx.) | 60 |

| Do you supply a registered address? | Yes |

| Local director required | No |

| Annual meeting required | Regular board meetings |

| Shelf company available | Yes |

| Electronic signature | No |

| Is accounting/annual return required? | Yes |

| Foreign-ownership allowed | 49% |

| Any tax exemptions available? | No tax on dividends |

| Tax incentives | Special tax regime for Qatar Science and Technology Park |

What are the steps for opening a company in Qatar?

Foreign companies that want to start a company in Qatar can open a branch or incorporate a new business entity. A requirement for doing business in the country for foreign corporations is to appoint a representative. One of our company registration agents in Qatar can help by answering your questions about the steps for business incorporation in the country. A few steps are mandatory for all investors who decide to open a company in Qatar:

- reserve a company name with the Commercial Registry and Trademark Department;

- open a bank account and deposit the paid-up capital;

- draw up the Articles of Association and submit them for approval from the Commercial Companies Control Department;

- authenticate the Articles of Association;

- submit the documents and register with the Commercial Registry belonging to the Chamber of Commerce and Industry;

- register for tax purposes and make a company seal;

- a trade license and signage license are obtained from the Municipality of Doha. Other special permits and licenses may be needed, as per the company’s activities.

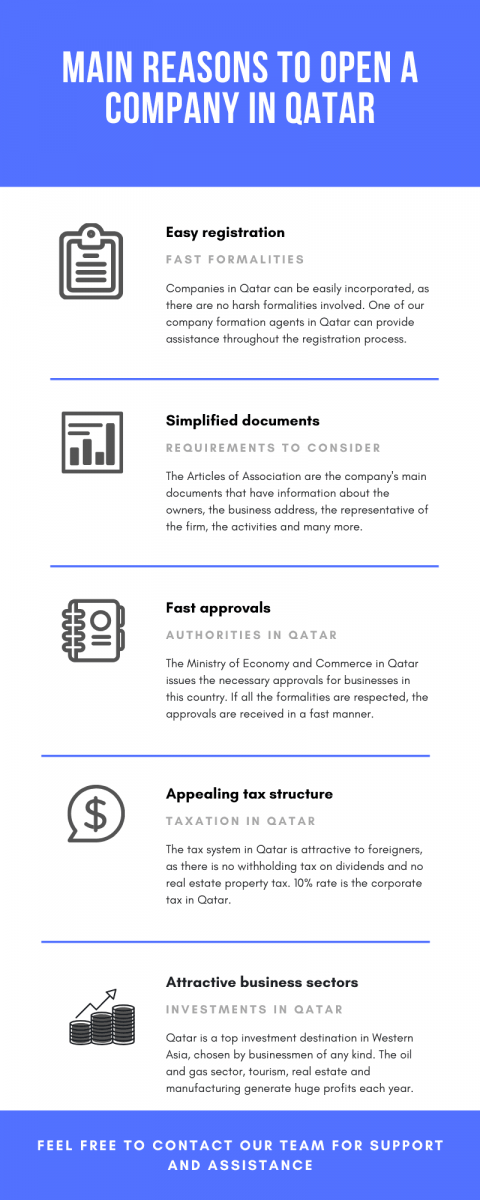

The procedures described above are a summarized description of the steps that need to be achieved in order to have a registered and operational legal entity. We recommend seeking advice from our specialists who can help you open a company in Qatar. Our team of experts can help you understand the process and abide restrictions imposed in respect to foreign ownership. Here is an infographic with information about business in Qatar:

What types of companies can I open in Qatar?

The most common types of companies for those who want to start a company in Qatar are the limited liability company, the public shareholding company, and the branch. Partnerships, joint partnerships, and limited partnerships, as well as joint ventures, are available business forms for those who want to set up a company in Qatar. Foreign investors in Qatar commonly choose to open a limited liability company. The majority of the businessses (51%) need to be owned by a Qatari national or by a group of Qatari national shareholders.

The Qatar Financial Centre and the Qatar Science & Technology Park are two special investment zones where foreign company incorporation is encouraged and where investors benefit from a special tax regime and regulatory framework. Companies incorporated in the Qatar Financial Centre are subject to a parallel legal framework, modeled after the English Common law. Full foreign ownership is permitted here and companies incorporated under this special regime can access the Qatar local market. One of our company formation agents can give you more information about this special Centre and about immigration to Qatar if you want to relocate your business.

Interested in residency in Qatar? Our team with experience in immigration issues can help you with the necessary formalities and procedures. With proof of residence, an employment contract, and a valid passport, this type of permit can be issued in a maximum of 4 weeks. You will also need to register with the local authorities. But you can find out all the information from our team of specialists in the field.

Registering an LLC in Qatar

The registration of a limited liability company in Qatar is made with the Ministry of Economy and Commerce. The incorporation is not complex, however, it is recommended to pay attention to the following aspects:

- A name verification and reservation need to be made before the documents are prepared.

- The Articles of Association and the Memorandum of Association need to be drafted in Arabic and then notarized.

- QAR 200,000 represent the minimum share capital that must be deposited in a local bank account.

- Depending on the business, special licenses and permits are needed.

It is important to know that foreign investors in Qatar cannot have more than 49% ownership in the company. This is why a local partner is needed for opening an LLC in Qatar. We can help you with starting a business in Qatar as a foreigner. We offer company formation services in Qatari main towns: Doha, Umm Said, Al Wakrah and Al Rayyan.

Our accountant in Qatar can offer you the services you need for the smooth running of the company if you choose to set up an LLC in Qatar. There are a number of aspects related to accounting that must be implemented according to the law. You can thus benefit from payroll, bookkeeping, and the preparation of annual financial statements. We also mention that it is much more advantageous to collaborate with one of our specialists, instead of setting up an entire accounting department.

The characteristics of the limited liability company

The limited liability company, or LLC in Qatar, is a type of company that has a minimum of two founders and a maximum number of fifty partners. In Qatar, this type of company is known as a WLL company in Qatar. Each of the shareholders is liable only to the degree of capital invested in the company – this limited liability characteristic makes it advantageous for investors. The minimum share capital for an LLC in Qatar is 200,000 QAR (approximately 45,832 EUR) divided into equal shares with a value of 10 QAR or more.

Foreign investors are allowed to hold a maximum of 49% of the company and the LLC must have one or more Qatari partners. In some business sectors, full foreign ownership may be permitted, however, it is recommended to talk to one of our Qatar company formation agents to clear information on the conditions for fully owning a business.

Qatar limited liability company registration in 2023

If you open an LLC in Qatar, it needs to be registered with the Ministry of Economy and Commerce. For this purpose, investors need to prepare the Articles of Association and the Memorandum in Arabic. Our Qatar company registration agents can help you during this step. The company needs to have a unique trade name and a corporate bank account. The company’s constitutive documents, together with the documents that prove the name availability are submitted to the Ministry of Economy and Commerce and the legal entity receives a commercial residence certificate. Additional charges, permits, or licenses may be needed according to each business activity undertaken by the company. Our experts, such as immigration lawyers in Qatar, can help you with information about the laws on licensing if you are from abroad. The trade license is one of these mandatory permits and it is also issued by the Ministry of Economy and Commerce.

The taxation and incorporation requirements differ in the Qatar Financial Centre and the Qatar Science and Technology Park. Investors should be well informed about the advantages of these special zones, including full foreign ownership permissions, before deciding to incorporate an LLC in Qatar in any of the areas.

One should note that the Computer Card is an important document that shows information about the person that represents and signs on behalf of the LLC in Qatar. The Immigration Office issues such documents.

Can I establish a branch in Qatar?

Yes, you can establish a branch in Qatar, respecting a few conditions in this direction. For instance, the first thing to do is to obtain a decree from the Ministry of Economy and Commerce in Qatar. The incorporation of a branch in Qatar is a complex process, however, the procedure involves a series of documents to prepare, plus the approvals of the authorities. Among these, the declaration showing the intention of establishing a branch, made by the parent company, is needed.

Moreover, The Articles of Association and the Memorandum of Association, a power of attorney and the certificate of registration for a foreign shareholder of the company from abroad are among the documents which need to be drafted at the Commercial Registry in Qatar. If you would like to set up a branch in Qatar, you should seek advice from our team of company formation agents in Qatar. Plus, if you want to hire foreign stuff, you can solicit the assistance of our immigration lawyers in Qatar. We can help you with all the required documents when you want to open a company in Qatar.

Can I purchase a shelf company in Qatar?

Yes, ready-made company in Qatar can be purchased by both domestic or international entrepreneurs wanting to start a business in Qatar and skip the registration formalities for opening a company from scratch in this country. The ownership transfer is the main process to consider when deciding on buying a shelf company in Qatar. It is good to know that a ready-made company is already registered in Qatar, it is kept on a ”shelf” until it ages, has no activities, and therefore no debts.

However, it is recommended to solicit company due diligence and make sure the ready-made company you wish to purchase has no problems and no liabilities. It is good to know that a shelf company has a bank account, and thus, it is ready to activate on the market. Entrepreneurs from abroad have many reasons to consider purchasing a shelf company, and among these, is the possibility of commencing the activities right away, as soon as the ownership transfer took place. Moreover, the company can be a good candidate for a bank loan, due to its clean history background and no liabilities. In-depth support for starting a business in Qatar as a foreigner can be offered by our team of consultants at any time. We can help you set up a company in Qatar in just a few days.

Can I open a holding company in Qatar?

Yes, holding companies can be established as limited liability companies and for QAR 10 million as minimum share capital for public companies. Holding companies are beneficial from a tax point of view because there is no withholding tax, VAT, or wealth tax imposed. Just like in the case of other types of companies, holding companies in Qatar must be approved by the Ministry of Economy and Commerce in Doha. We mention that a shareholding company in Qatar must be established by at least 5 stockholders, not exceeding 11.

All shareholders need to agree on the type of holding company, whether private or public. Holding companies in Qatar can have control of several firms but without performing economic operations. The registration of a holding company in Qatar is not complicated, but as a foreign investor, you should solicit the support of a company formation agent in Qatar. Let us tell you more about starting a business in Qatar as a foreigner.

Interested in immigration to Qatar? You have at your disposal the legal services offered by our specialists. They can prepare the necessary documents to be able to obtain a tourist, work, family, or student visa, depending on the reasons for relocation. They can also take care of the formalities for obtaining a residence permit in this country. We mention that a clear criminal record is required by the authorities in this endeavor.

The liaison office in Qatar

A liaison office in Qatar is a representative office chosen by international entrepreneurs who are interested in presenting their business on the market. This is a great choice for businessmen who want to develop marketing activities and see what kind of clients they can target. A representative office in Qatar can be established without minimum share capital, it has no financial activities and cannot agree on signing contracts of any kind. Promoting the foreign business in Qatar can be easily done with the help of a liaison office in Qatar, mentioning that this office will act under the same name as the one of the parent company. All the formalities for registering a liaison office in Qatar start with the Ministry of Economy and Commerce in Qatar, the institution that issues the needed approvals. All the formalities of a liaison office can be handled by one of our company formation representatives in Qatar who can hep you set up a company in Qatar as soon as possible.

How can I open a bank account in Qatar?

Opening a bank account in Qatar is not a complicated procedure, not even for foreigners in this country after they set up a company in Qatar. International investors must open a bank account when the registration of a company starts. A copy of a valid passport and company documents are needed for opening a bank account in Qatar after starting a business in Qatar as a foreigner. As for natural persons in this country, they will need to provide a letter from the company they work for if they want to open a bank account. Foreigners should discuss further details about immigration to Qatar and related formalities with our local experts.

Virtual office in Qatar

Virtual office services can be chosen by businessmen who do not want to set up a traditional office in Qatar in the first place. They can benefit from a complete package and a series of services. A notable business address, call answering and forwarding, secretary services, mail collection and forwarding, fax services and a virtual assistant are among the services comprised by a virtual office package. People can also ask for extra meeting rooms and bank statement collection. The costs for virtual office packages in Qatar can be requested from our company formation agents in Qatar. One of our specialists can also give details about how you can open a company in Qatar, mentioning that we can help you with the authorities in charge of the incorporation.

Company taxation in Qatar

Qatar has a low taxation regime, with a minimum number of taxes on corporate profits and no taxes on income from employment. The corporate tax rate in Qatar is 10%, with a higher 35% rate for gas and/or oil operations. There is no withholding tax on dividends, no capital duty, payroll tax or real property tax. Qatar does not levy a value-added tax. One of our company formation agents in Qatar can give you complete details on tax compliance for companies anf help you with starting a business in Qatar as a foreigner.

Short details about the Trade Register in Qatar

The registration process of a company in Qatar starts with the Commercial Registry and the local offices, depending on the city you wish to operate in. The flux of foreign investors made the authorities in Qatar develop a one-stop-shop system, mentioning that all the formalities for registration are made in just one place. The Trade Register in Qatar is under the jurisdiction and control of the Ministry of Economy and Commerce, meaning that all the approvals are issued by the Ministry.

Moreover, the Commercial Registry allows entrepreneurs or natural persons to make company verifications, meaning that information about the name of the company, owners, number of employees, and the date of registration is available for anyone, free of charge. Instead of dealing with issues when registering a company in Qatar, you may seek support from our team of company incorporation agents in Qatar who can help you draft the documents with the Commercial Registry.

When opening a company in Qatar investors are required to register with the Commercial Registry and the Chamber of Commerce, within the one-stop-shop system in place with the Ministry of Economy and Commerce. The details about the company, available with the Commercial Registry include the name, contact details, authorized individuals, number of employees and the names of the company directors and managers.

You can search public records by knowing the company ID. One of our company registration agents in Qatar can help you perform a Companies Registry search.

Company details for Qatar Financial Centre companies

Companies registered with the Qatar Financial Centre, a special investment zone, are under a different taxation and registration regime. The Qatar Financial Centre (QFC) public register of companies is a separate one where individuals may find information on companies registered in this special investment zone.

Individuals can search the online database for companies registered and operating within the QFC via the online portal. The data available concerns the type of legal entity, the status of the company (licensed, suspended license, insolvency or inactive), its address, details about its founders/shareholders and information concerning the types of activities the company is licensed to perform in Qatar. All those wishing to use the QFC online portal for company verification must know the company’s name and/or QFC number.

Making investments in Qatar

Qatar is a well-known investment center that is found on the list of numerous international entrepreneurs who want to do business in this part of Asia. The economic stability, the experienced local workforce, and the multitude of business choices are among the advantages of the business environment in Qatar. Here are numerous companies activating in the oil & gas sector, the most prolific in Qatar and the field in which foreign investors enjoy huge profits. The following data and information highlight a little bit about the business direction and economy of Qatar:

- The USA, South Korea, Japan, and Singapore are the main FDI contributors in Qatar;

- Most of the foreign investments are directed to the financial services sector, construction, oil & gas, public works;

- Approximately USD 32,743 million was the total FDI stock registered in Qatar in 2018;

- The 2020 Doing Business report revealed by the World Bank ranks Qatar 77th out of 190 economies in the world;

- The corporate tax rate in Qatar is set at 10%, representing one of the tax advantages for international investors in this country;

- The inexpensive workforce and the great infrastructure are also important and solid business benefits provided by Qatar to foreign investors.

Moody’s credit rating for Qatar

In July 2017, Moody’s Investors Service set the rating of Qatar at Aa3.

An Aa3 rating represents the fourth highest rating in Moody’s Long-term Corporate Obligation Rating. Obligations which are rated Aa3 are considered to be of high quality and have an extremely low credit risk.

The system of rating securities was first utilized by John Moody in 1909. The purpose of this rating was to confer investors a basic system of gradation in which the future connected creditworthiness of securities can be gauged. Our Qatar company formation consultants can further explain this aspect. We also offer help to open a company in Qatar.

The gradations of creditworthiness are pointed out by rating symbols, with each of them representing a group in which the credit features are mainly the same. There are nine symbols, starting with what is used to designate the least credit risk to the one symbolizing the greatest credit risk.

The rating of Aa3 considers certain credit strengths which characterize country’s credit profile and mirrors Moody’s point of view that the sizeable net asset position of the domestic government and the great levels of wealth would continue to sustain the sovereign credit profile at the time the rating was issued.

Standard & Poor’s credit rating for Qatar

In August 2017, Standard & Poor’s Global Rating issued the credit report of Qatar, which maintained it at AA-.

Standard and Poor’s declared that they expected the ongoing boycott of the local economy to lead to a slower economic increase and hinder the fiscal performance. Our company registration agents in Qatar can provide further details related to this matter.

The rating affirmation mirrored the expectation that the local government would continue to manage the impact of the boycott while maintaining Qatar’s score rating at the same levels.

Qatar is ready for business and welcomes investors from all over the world. The energy industry is among the appealing sectors in which investors activate, considering that Qatar is rich in oil reserves and natural gas. Moreover, the authorities have improved the business environment, letting investors easily establish their presence in varied fields of interest.

Frequently asked questions

Qatar is one of the wealthiest countries in the world. The reason for this is because of the governmental policies which have proven to be extremely successful. The country presents a favorable business environment due to the investment incentives, banking services, political and social stability, as well as infrastructure.

The business entity types in Qatar are:

• partnership company;

• limited partnership company;

• limited liability company;

• single person company;

• holding company;

• particular partnership company;

• shareholding company;

• limited share partnership company.

Our Qatar company formation advisors can provide all the necessary information on these types of business entities, as well as assistance related to setting up a company in Qatar.

The most popular form of business entity established by foreign investors in Qatar is the limited liability company (LLC). Most of the times, a foreign entrepreneur requires one or several local partners to get involved in the business and to act as the majority shareholder. We can help you with business setup in Qatar.

The main characteristics of an LLC in Qatar are:

• A minimum share capital of QR 200,000;

• An office space is necessary for at least one year lease to obtain the trade license;

• At least 51% of the company has to be owned by a local citizen, except if an exemption was issued;

• 10% of the yearly net profits have to be kept inside the business until the legal reserve attains 50% of the share capital.

Branches in Qatar are utilized to effectuate specific governmental contracts. They must be authorized by the Ministry of Economy and Commerce to establish if the contract is “government qualified”. The branch in Qatar does not require a local partner. Our company registration agents in Qatar can provide more details related to this form of business.

This business entity, usually named a “shop window”, is set up by foreign investors without having to present a local partner. However, the trade representative office cannot effectuate commercial activities in Qatar. Its sole purpose is to display its products or services.

Companies in Qatar which are owned by foreign citizens have to pay taxes on their profits. Local companies do not pay taxes, however, foreign partners must do so on their share of the company.

The tax rates start at 10% at profits between QR 100,000 and QR 500,000 and can reach up to 35% for income above QR 5,000,000.

A direct legal presence can be achieved in the country by setting up a branch of a foreign company.

All taxpayers in Qatar have to submit accounts in maximum four months from the end of the financial year. We can also help you with business setup in Qatar.

Ownership of property in Qatar is restricted to local citizens. Citizens from the Gulf Cooperation Council countries can own land without restrictions in three special areas managed by Qatar Diar.

Please feel free to contact our team of consultants for assistance during opening a company in Qatar, regardless of the business structure you choose.